The mortgage so you can Toronto a house designer Sam Mizrahi is advanced of the a tiny funding car produced by Bridging’s creators, Jenny Coco and you will Natasha Sharpe, however, remains unpaid 10 years afterwards

This new Mizrahi loan is underwritten thanks to an organization called Connecting Capital Inc

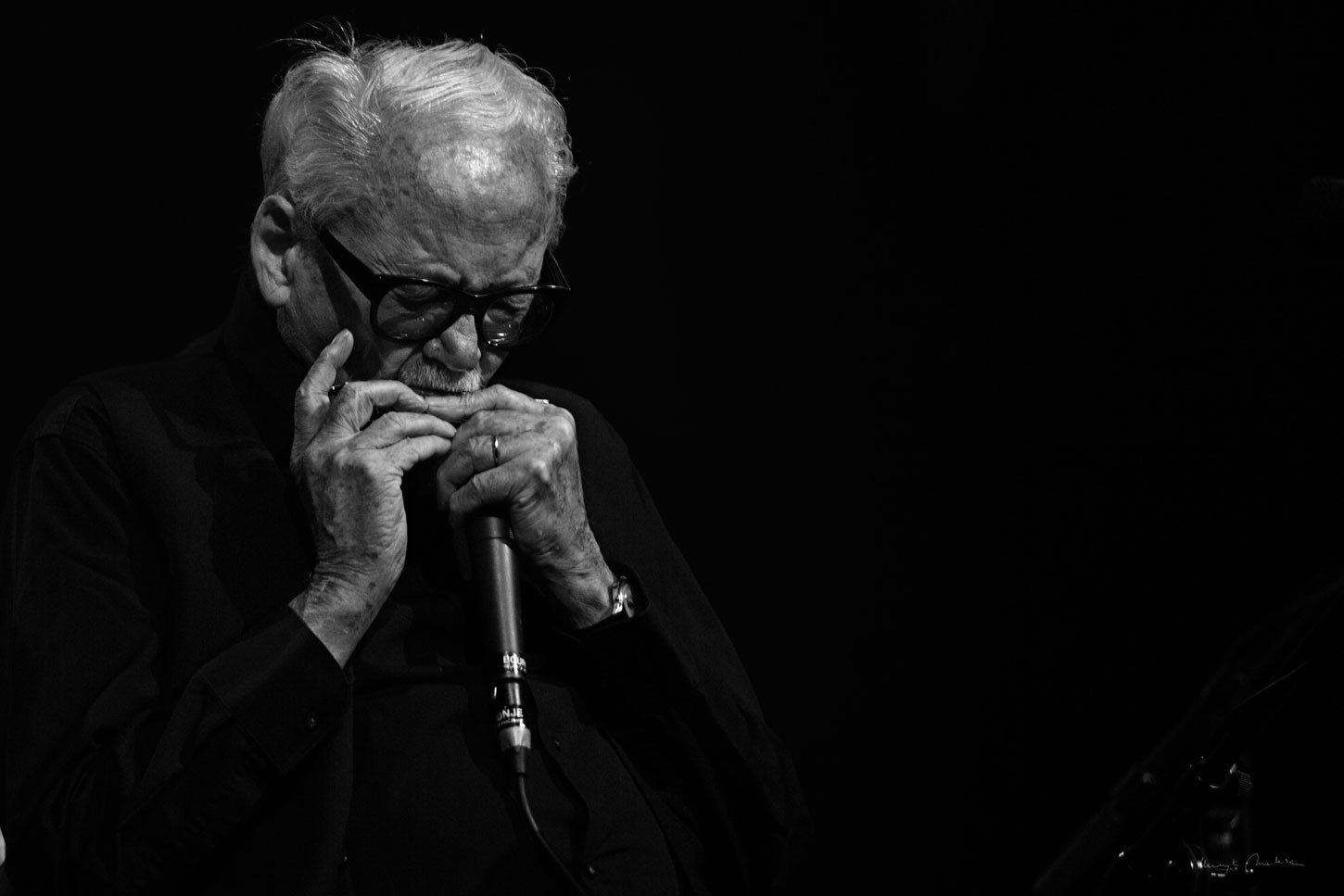

Connecting Finance’s you can disagreement of great interest problems deepen having a loan in order to Sam Mizrahi to develop 181 Davenport during the Toronto (envisioned left during the 2016) Fred Lum/The planet and Send

Certainly one of Connecting Funds Inc.is why worst-doing money is actually cutting-edge to help you a business spouse out-of Jenny Coco, the non-public lender’s bulk owner, and also the personal debt has languished into Bridging’s guides to own 10 years, Earth and you will Post possess learned.

Earth even offers found that obligations on the personal debt altered give. Initial, the loan so you’re able to Toronto a residential property creator Sam Mizrahi try complex of the a tiny financial support vehicles developed by Bridging’s founders, Ms. Coco and you will Natasha Sharpe. not fast and easy title loans Maryville TN, it was afterwards assigned to Bridging’s leading shopping trader funds, although it was at possibility with the way the merchandising financing are ended up selling to help you traders. By transfer, the new fund’s traders are actually saddled into crappy financial obligation.

Mr. Mizrahi is now the fresh power behind The one, an extended-defer deluxe skyscraper now less than build at part off Yonge and you may Bloor Avenue during the downtown Toronto. The one, that’s backed economically by the Ms. Coco, was among the tallest homes from inside the Canada shortly after they was erected.

The Globe’s findings throughout the Mr. Mizrahi’s loan, which was not made meant for The main one, however, a prior condo invention, draw the first stated such in which Bridging offered money so you can a debtor that have extreme commercial connections to Ms. Coco. Nevertheless they improve way more questions regarding whether or not Connecting made sufficient disclosures towards backlinks between their possession category, their officials and its own borrowers. Not only is Ms. Coco Bridging’s vast majority holder, she in addition to seated into the borrowing panel that recognized the loans.

The mortgage involved is to begin with worthy of $sixteen.3-mil and you will try complex into the 2012 in order to a pals controlled by Mr. Mizrahi. During the time, Bridging try a little individual bank subject to Ms. Coco, her sis Rugged Coco and Ms. Sharpe, who was Bridging’s president and you can a minority manager.

A couple of years afterwards, inside the 2014, an element of the financing was assigned to the fresh Sprott Connecting Earnings Finance, which had been a good investment vehicle Connecting co-created with Sprott House Management to help you interest merchandising investors. A lot of mortgage was next gone to live in so it shopping funds.

Within time the loan was initially tasked, Ms. Coco entered into the a real house commitment that have Mr. Mizrahi to grow The one. Because the 2014, Ms. Coco provides injected $30-billion regarding equity on investment and now have borrowed The one $90-billion.

The one grew to become are mainly based, but Bridging’s mortgage in order to Mr. Mizrahi has been around standard due to the fact 2018, The world enjoys read. The full financing dimensions provides ballooned so you’re able to $48-billion whilst does not pay dollars attention. As an alternative, its compiled appeal is included to help you their dominating. It structure is frequently used by stressed individuals who will be brief on the cash.

None of your own activities really responsible for the first financing, or for its move into new Sprott Bridging Earnings Finance, responded to several directories off detail by detail questions delivered because of the Business

But not, Bridging Loans is now below research because of the Ontario Bonds Fee and you may possible problems interesting were a switch attract regarding this new probe. New regulator along with put Connecting under the control over a court-designated person when you look at the , after understanding multiple problematic loans and you may alleged impropriety. In a single instance, Bridging’s largest borrower allegedly directed $19.5-million towards personal chequing membership from then Bridging President David Sharpe, Ms. Sharpe’s partner.