When it comes to investment your residence, you to definitely dimensions will not complement the. Even though conventional choices such as money, domestic guarantee lines of credit (HELOCS), refinancing, and opposite mortgages could work better for many home owners, brand new present go up from mortgage solutions such as for instance family collateral people and you can almost every other growing systems have made it obvious that there surely is an expanding interest in other options. Discover more about option how to get guarantee from your own household, in order to make a told choice.

Conventional Choice: Advantages and disadvantages

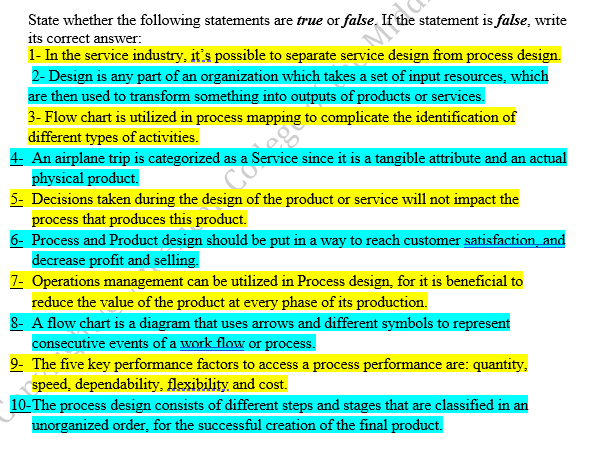

Loans, HELOCs, refinancing, and you may reverse mortgage loans can all be attractive a means to make use of the brand new security you have accumulated of your property. However, you can find often as much drawbacks as there are advantages – therefore it is crucial that you see the pros and cons of each and every to understand as to the reasons particular people require funding possibilities. Comprehend the chart less than in order to rapidly evaluate loan choice, up coming continue reading for lots more all about for each.

House Guarantee Loans

Property security financing the most popular indicates one homeowners supply the collateral. You will find gurus, and a foreseeable monthly payment due to the loan’s repaired attention speed, and also the simple fact that you are getting the new equity in a single swelling contribution payment. For this reason, a property guarantee financing generally is sensible if you are looking so you can shelter the price of a restoration venture otherwise highest one-from expense. Also, your own focus repayments is generally tax-allowable if you find yourself making use of the currency having renovations.

As to the reasons identify a house guarantee loan option? Several grounds: First, you’ll want to repay the mortgage along with their typical home loan repayments. Assuming the borrowing from the bank was less-than-higher level (less than 680), you do not even be recognized for a house collateral loan. Finally, the applying procedure is going to be invasive, troublesome, and you can taxing.

Home Security Credit lines (HELOC)

HELOCs, a familiar replacement a property collateral mortgage, provide easy and quick entry to financing should you decide need him or her. And while your generally speaking you prefer at least credit score out of 680 in order to qualify for an effective HELOC, it can in fact help you improve your rating over the years. Also, you’re capable appreciate tax professionals – deductions as much as $one hundred,one hundred thousand. Once the it’s a credit line, there is absolutely no interest owed if you don’t take out currency, and you may remove to you desire up until you struck the restriction.

However with which self-reliance will come the potential for additional debt. Such as, if you plan to use it to pay off credit cards which have large interest levels, you might end racking up way more costs. Which actually happen frequently that it is proven to loan providers as reloading .

Various other significant downside that may encourage residents to get a HELOC choice is the instability and unpredictability which comes along with this option, since variability when you look at the costs can result in changing bills. The bank can also freeze your HELOC any time – or reduce your borrowing limit – in the event of a drop in your credit rating or home worthy of.

Discover how popular its getting homeowners like you to use to possess home loans and HELOCs, within 2021 Resident Declaration.

Cash-out Re-finance

One to replacement for a property collateral loan are an earnings-out re-finance. One of the greatest rewards off a funds-away refinance is that you can safer a lowered interest on your mortgage, for example straight down monthly payments and a lot more cash to fund other expenses. Or, if installment loans El Paso no credit check you can make higher money, a beneficial refinance would-be a great way to shorten your financial.

However, refinancing features its own gang of demands. Given that you may be basically paying down your current financial with a new one, you happen to be extending your own home loan timeline and you’re saddled with the exact same costs you handled the first time around: app, closure, and origination costs, term insurance, and perhaps an assessment.

Full, you may spend anywhere between several and you may half dozen % of your own overall matter your acquire, according to certain financial. But-called no-cost refinances are going to be inaccurate, as you will likely have a higher rate to compensate. In the event your count you might be borrowing from the bank are higher than 80% of the home’s well worth, you will likely have to pay getting personal financial insurance rates (PMI) .

Cleaning the fresh hurdles out of application and certification can result in inactive ends for the majority residents that imperfections to their credit rating otherwise whose scores merely aren’t high enough; very loan providers want a credit score of at least 620. These are just a number of the causes residents will discover on their own seeking a substitute for a funds-aside refinance.

Contrary Home loan

And no monthly installments, an opposing financial would be ideal for earlier people selecting extra money through the advancing years; a recent estimate in the National Opposite Mortgage brokers Connection receive one to seniors got $seven.54 trillion tied for the a home equity. But not, you happen to be nonetheless responsible for the fresh percentage from insurance rates and you will taxes, and need in which to stay the house on life of the loan. Opposite mortgages also have a years dependence on 62+, and that laws it out as a practical option for many.

There is a lot to take on when examining antique and solution ways to availability your home equity. The following publication helps you navigate for each and every solution even more.

Searching for an option? Go into the Household Security Financial support

A newer replacement domestic security finance try household equity financial investments. The key benefits of a house guarantee investment, instance Hometap even offers , otherwise a discussed fancy agreement, are many. Such dealers make you near-quick access into collateral you’ve produced in your house during the change getting a share of their coming worthy of. After the fresh new investment’s productive period (and that utilizes the company), your accept brand new investment by purchasing it having deals, refinancing, otherwise selling your residence.

That have Hometap, and additionally an easy and seamless app procedure and book certification criteria that is have a tendency to even more inclusive than regarding loan providers, you will have some point from contact from the money feel. Perhaps the important improvement is that in lieu of these more traditional avenues, there are not any monthly payments or notice to consider towards the best of one’s mortgage payments, in order to reach finally your monetary wants reduced. While seeking to choice the way to get collateral from your family, coping with a property equity trader would-be really worth examining.

Try an excellent Hometap Capital the right domestic guarantee mortgage alternative for your possessions? Just take our very own four-minute quiz to find out.

I manage all of our far better make sure all the info into the this post is because exact as you are able to as of the fresh new go out it is typed, but one thing transform rapidly often. Hometap cannot endorse otherwise monitor one connected websites. Personal things disagree, thus check with your very own money, income tax or law firm to see which is reasonable to you personally.