So if you’re going to owe $1,200 a month in student loans, you’re going to need to bring home $120,000 a year

- Where will you live? How much will housing and transportation cost?

You could stretch to 15%, in which case you would need to earn $80,000 to afford the $1,200 a month payment.

Okay, is anybody laughing at me? Chances are some of you have student loan payments just from undergrad degrees that far exceed 10% of your annual income.

This is perhaps the biggest reason why twentysomethings today can’t get ahead. It’s not necessarily your fault-tuition inflation, stagnant wages, and the failure of colleges and lenders to educate students about the cost of borrowing have contributed to this crisis.

BUT, if you’re considering going back to graduate school, you’ll want to consider how affordable your loans will be after you graduate.

So if you’re going to owe $1,200 a month in student loans, you’re going to need to bring home $120,000 a year

- First, you want to make sure that borrowing the cost of tuition will enable you to get a job in which you can afford to repay your loans.

- Second, you’ll need to consider how much you’ll borrow for living expenses.

Let’s say that you currently earn $50,000 a year and bring home about $36,000 after taxes. If you go back to school and do not want to work part time OR reduce your lifestyle, you’ll need to borrow $36,000 a year in addition to tuition just to live on.

Let’s say you’re going to law school for three years. $36,000 a year for living expenses totals $108,000 over three years. Yikes! If you’re going to repay that over 10 years at 6%, that’s a $1,200 monthly payment JUST FOR LIVING EXPENSES.

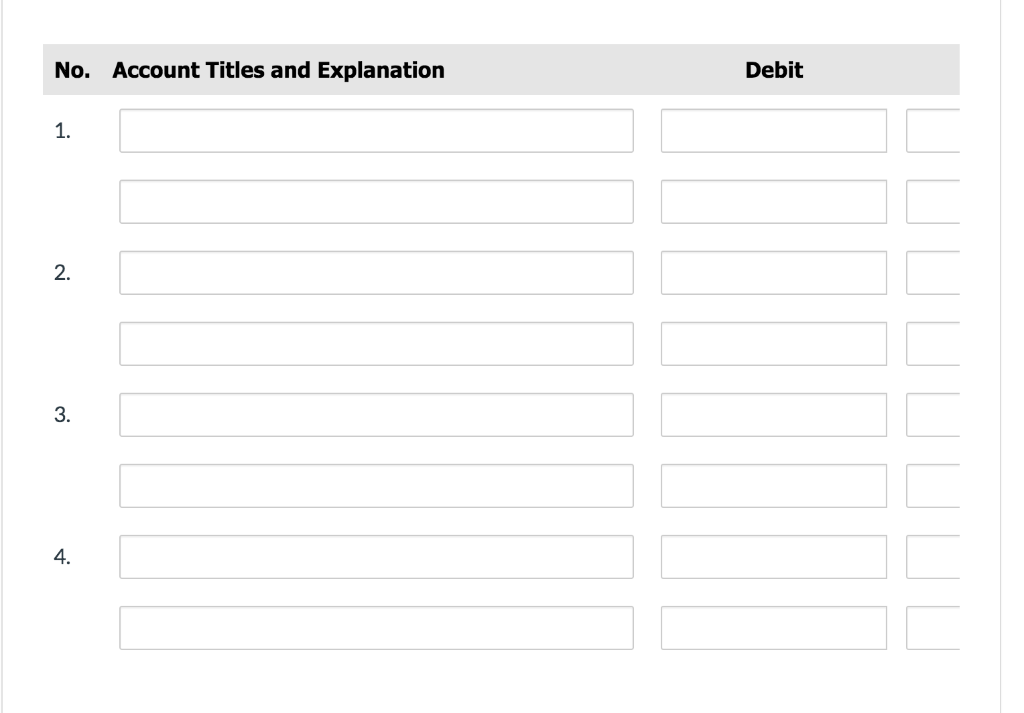

Here’s an easy way to estimate how much it costs to borrow money for grad school. Keep in mind that the total interest figures don’t take into account interest that accrues while you’re still in school, so the actual costs will be higher.

So if you’re going to owe $1,200 a month in student loans, you’re going to need to bring home $120,000 a year

- It allows you to pursue a career you’re passionate about that you can’t do without the degree

- And/or you can substantially increase your lifetime earning potential with an advanced degree

Let’s say you’re 25 and earning $35,000 a year. Assuming an average 3% annual raise and that you work until 65, you’ll earn a lifetime total of $2.75 million.

Now let’s say you go to law school for three years. During those years you earn $8,000 a year working part-time. The total cost of borrowing (including interest) is $206,331 (paid over 20 years). When you graduate at 28 you earn $60,000 to start.

Over your lifetime, with the law degree, you’ll earn $4.14 million. Subtract the cost of going to school ($206,331) and you still earn $1.2 million more than if you hadn’t gone to law school.

Now let’s https://tennesseepaydayloans.net/cities/nashville/ say you’re 30 years old earning $50,000. You decide to get an master’s degree full-time and not work while in school for two years. You borrow $75,000 a year for two years ($45,000 tuition plus $30,000 in living expenses) that costs you a total of $257,914 to repay over 20 years at 6%.

When you graduate, you find that the master’s gets you a slight raise to $60,000. Between the ages of 30 and 65 had you NOT gone back to school, you would’ve earned a total of $2.5 million.

Having gone to school full time for two years and borrowing the money, your lifetime earnings with the master’s (minus the total cost of obtaining it) come out to $2.45 million. Not a huge difference, but here’s an example of when going back to grad school could actually decrease your lifetime earnings.